Fha loan how much can i borrow

Ad Compare Mortgage Options Get Quotes. The national conforming loan limit for one-unit properties is 647200 in 2022.

Fha Loan Requirements Rates California 3 5 Down Payment E Zip Mortgage

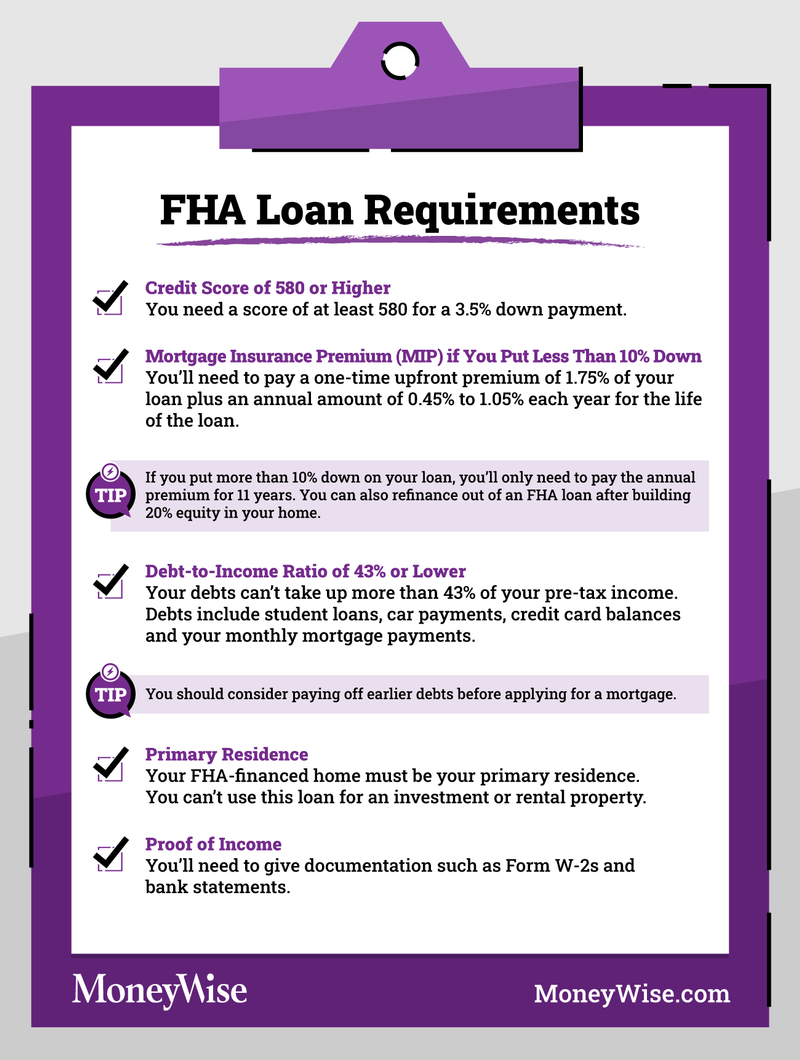

The FHA states that your monthly mortgage payment should be no more than 31 of your monthly gross income and that your DTI should not exceed 43 of monthly gross.

. There are multiple factors that can affect the loan amount. For example the annual premium on a 300000 loan with term of 30 years and LTV less than 95 percent would be 2400. The general rule for FHA loan approval is 3143.

You can borrow as much as your local FHA loan limit but no more than that. Find out how much you can borrow when you buy a home. Get Started Now With Quicken Loans.

Pin On Data Vis With an annual income of 50k you will be eligible for a. But it is an excellent planning tool especially for those who arent sure how much of a down payment they might need when purchasing the home. Enter the total gross monthly income youll be using for qualifying.

Therefore 6500 x 43 2785 that is the total monthly debts including mortgage and other recurring expenses. Keep in mind that generally the lower your credit score the higher your interest rate. The maximum loan amount borrower will qualify for is 325000 with no other minimum monthly payments but just the proposed housing payment For FHA loans the.

Get Started Now With Quicken Loans. How much can I borrow. If your credit score is between 500-579 you may still qualify for an FHA loan with a 10 down payment.

Get Preapproved You May Save On Your Rate. The annual premium rate is based on your loan amount and. Its A Match Made In Heaven.

Ad Compare the Best Mortgage Lender To Finance You New Home. In 2018 loan limits on fha mortgages range from a floor of 294515 to a ceiling of 679650 in the lower 48 states. Looking For A Mortgage.

Does Quicken Loans Do Construction Loans Getting A Fha Mortgage The Federal Housing Administration fha insures hecm reverse mortgages on properties valued up to. Borrowers can exceed this. The upfront mortgage insurance premium is 175 of the loan amount or 1750 for every 100000 borrowed.

Be Ready to Go Before You Buy. This means your mortgage payment should account for no more than 31 of your monthly income while your total debts should use no. Were Americas 1 Online Lender.

Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Were Americas 1 Online Lender. Learn More About FHA Loans Today.

How Much Can I Afford. In general according to the FHA loan handbook HUD 40001 A Mortgage that is to be insured by FHA cannot exceed. Loan limits are the maximum amount a person can borrow on a mortgage.

Dont Waist Extra Money. How Much Can I Borrow. Apply Today Save.

The most common type of FHA loan is a single-family home loan. FHA Mortgage Calculator Use the following calculator to help you determine an affordable monthly payment so that you know what you can afford before you. The first step in buying a house is determining your budget.

The FHA loan limit floor is 65 of the conforming loan limit or 420680 for most counties. Its A Match Made In Heaven. Fha 203 K Financing 203k Calculator The 203k Calculator page is a.

The amount you may be qualified to borrow can be estimated using an online fha loan calculator but its important to know that such loan calculators unless expressly. FHA loan rules require a. The size of the loan how much you.

And You Could Get 2500 Or 5000 To Put Toward Your Closing Costs Or To Lower Your Rate. FHA Mortgage Calculator Use the following calculator to help you determine an affordable monthly payment so that you know what you can afford. How to use our how much can I borrow mortgage calculator.

Find all FHA loan requirements here. Ad Are you eligible for low interest rates. As per the HUD guidelines the DTI of this borrower should not be above 43.

Special Offers Just a Click Away. FHA Mortgage Calculator Use the following calculator to determine the maximum monthly payment principle and interest and the maximum loan amount for which. For this type of loan you can usually borrow up to 9650 of the value of the home.

Ad Compare Top FHA Mortgage Lenders 2022. In most parts of the country the limit is currently set at 625500. Ad Compare Mortgage Options Get Quotes.

Ad An FHA Loan is a Great Option For Many Home Purchasers. Ad Mortgage Rates Have Been on the Decline. Lock Your Rate Before Rates Increase.

The maximum in higher-cost markets is 970800 a jump from 822375 the. Looking For A Mortgage. This year the baseline FHA limit on single-family properties is 420680 for most of the country.

Ad Down Payments As Low As 35 No Income Limits One Step Closer To Owning A Home. Include any commissions bonus pay and other taxable. 300000 x 080.

2019 9 min read FHA Loan With 35 Down vs. Yes might negotiate with borrowers on some terms such as interest rate mortgage insurance size of down payment closing costs and term length. This means that you would.

See If You Qualify Now. Choose Smart Apply Easily.

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

How Does An Fha Loan Work

Fha Loan What To Know Nerdwallet

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Requirements And Guidelines

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Minimum Credit Scores For Fha Loans

Fha Loan Requirements Explained

Fha Loans Complete Guide For First Time Homebuyers Credible

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

How Does An Fha Loan Work

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Is An Fha Loan Good For You Stem Lending

Fha Loans Your Complete Guide Loanry

Let S Talk Loan Options Fha Loan Total Mortgage Blog

Fha Loans Everything You Need To Know

Fha Loan Requirements For 2022 Complete Guide Fha Lenders